Our ...

July 2025 NewsletterSince the Government announced that pension savings will be subject to IHT from April 2027, we have received many requests for help and advice, with people questioning whether pensions remain an effective tax planning option at all. In this issue we have therefore focused on IHT and pensions to shed some light on the potential impact of the changes and what action, if any, we should be taking. We have also highlighted the obligation we all have in respect of our own income tax liabilities and when we should be informing HMRC if we believe tax is due. And for those of you invested in Abrdn MyFolio Market funds we have included a note about the recent name change and fund merger.

We hope you find the articles useful.

In this issue:-

- Why you may not need to worry about IHT on pensions

- Pension v ISA: why pensions are still the best place to save

- Gifts out of surplus income: 15 points to consider

- Could you be liable for tax penalties

- Abrdn MyFolio Funds merger

PLEASE NOTE:

These articles do not constitute any form of personal advice or recommendation and are not intended to be relied upon in making (or refraining from making) any investment or financial planning decisions.

Why you may not need to worry about IHT on pensions

The introduction of IHT on pensions from April 2027 has placed both estate planning and pension funding under the microscope with income tax potentially payable on death benefits paid after age 75, combined with potential IHT from 2027.

However, could concerns about IHT on pensions be overstated? Often we can underestimate longevity, the effects of inflation and the cost of retirement – which may see us use more of our pension funds/investments during our lifetime. A 65-year-old male has an average life expectancy of 86 and a 1 in 4 chance of reaching 94. For females of the same age, life expectancy increases to age 89 with a 1 in 4 chance of reaching 96¹. Even those retiring at State Pension Age could still have two decades of retirement ahead of them to fund.

The cost of retirement

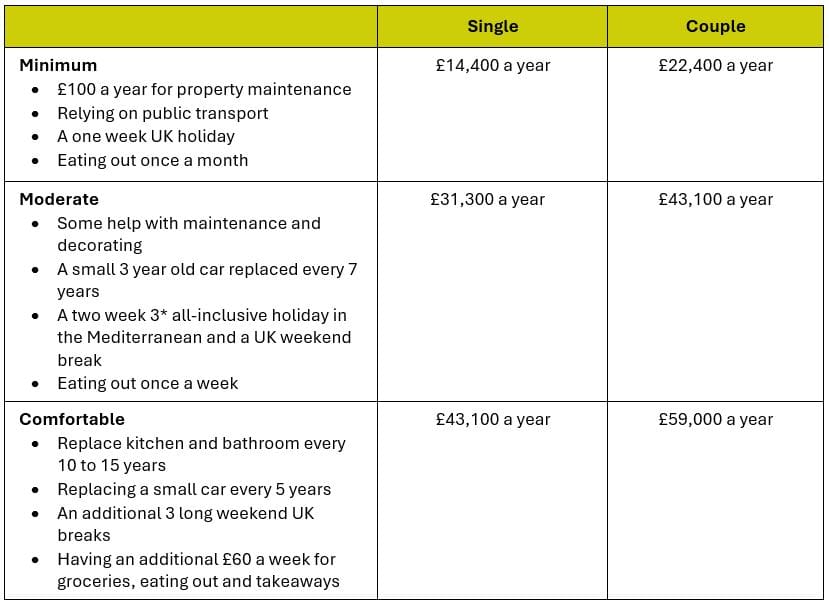

An independent report by the Pension and Lifetime Savings Association² (PLSA) released in February 2024 calculated the income a single person and a couple would need each year to achieve a “minimum”, “moderate” and “comfortable” standard of living and the results are set out in the table below:

The full New State Pension is £11,973 a year in 2025/26, meaning there could be a significant shortfall for those retiring with little pension provision who want to enjoy their retirement.

It should also be noted that the figures quoted in the table above are after tax, so a single person targeting a “moderate” retirement would need gross income of nearly £36,000 a year. Assuming they retired at 65 and were entitled to the full New State Pension at 67, they would need a fund in the region of £600,000* to meet the “moderate” standard of living with their income increasing each year by 3%.

* Assumptions

- Investment growth of 3.5% net of charges

- Fund exhausted after 25 years

- £64,000 tax-free cash used to meet income in first two years

Long term care

Those who meet, or exceed, average life expectancy are also more likely to need care in later life, further increasing the costs of their final years. The research by PLSA does not include the potential costs of later life care and these could significantly increase the cost of retirement. Current research3 indicates that the average cost of residential care in the UK is £1,266 a week, increasing to £1,554 a week for dementia nursing care. With life expectancy in care homes ranging from 2.2 years for males aged 90 and over, and 7 years for those aged 65-694, costs could quickly reach six figure sums for those who must fund their own care.

Inflation

The cost of living will also increase year on year as inflation bites. The state pension increases with inflation, so do defined benefit pensions. Annuities can have escalation included but at a significant cost. Drawdown income can be adjusted year-on-year to meet rising costs, but investment returns will dictate a sustainable level of withdrawal.

To put the effect of inflation into perspective, an individual who retired in 2015 with annual expenditure of £20,000 would need £27,218 today to maintain the same standard of living, assuming all of their costs had increased by CPI5.

Conclusion

We can see that many retirees may end up needing to draw most, or all, of their pension to meet their living costs. But there is also the possibility of dying at a relatively early age and IHT could be of concern if pension savings, when added to other assets, exceed the nil rate band. However, many individuals face a far greater risk of outliving their savings and any potential IHT liability may of course be met by taking out whole of life cover in trust.

Ultimately, these IHT changes will affect those with significant assets and we will be taking this into account in all future financial planning for our clients. Please get in touch with your usual JJFS contact for more information or to discuss further.

1 Life expectancy calculator.

2 https://www.retirementlivingstandards.org.uk.

3 https://www.carehome.co.uk/advice/care-home-fees-and-costs-how-much-do-you-pay.

4 Life expectancy in care homes, England and Wales – Office for National Statistics.

5 https://www.bankofengland.co.uk/monetary-policy/inflation/inflation-calculator

Pension vs ISA: why pensions are still the best place to save

Pension vs ISA for retirement

Pensions have long been accepted as the most tax efficient way of saving for retirement and this should remain the case even after the introduction of IHT in 2027. Both pensions and ISAs protect your savings from income tax and capital gains tax but the key difference is the tax relief on pension contributions and tax-free cash available on pension withdrawals.

If your ultimate goal is income during retirement then pensions are generally more compelling, unless you are taking withdrawals with no tax-free cash and paying tax on those withdrawals at a higher rate than the tax relief received on contributions. However, most people will pay tax at a lower rate in retirement than when they were working, so even without growth, and even after tax, the headline amount available in the pension will be higher than the headline amount available in the ISA which does not attract tax relief or any tax free benefits.

For example, a gross pension contribution of £16,667 would cost a higher rate taxpayer £10,000. Ignoring growth, the return when withdrawn in retirement, even if the individual is still a 40% taxpayer, is £11,667 (£7,500 income after tax plus £4,167 tax-free cash). The same £10,000 invested in an ISA will still be £10,000 when taken. The spendable pot from the pension after all taxes is therefore 16.67% more than an ISA simply because of the tax treatment.

Pension vs ISA for death benefits

Pension death benefits will not be subject to IHT if they are left to a spouse or civil partner, which is similar to ISAs. However, from April 2027 the pension will have IHT deducted first, and then the balance will be taxed at the beneficiary’s marginal rate of income tax, if the original scheme member died aged 75 or over. This results in a double taxation of the funds under current proposals.

However, if the death occurred before age 75, no income tax is payable by the beneficiary on the funds drawn, unless paid as a lump sum exceeding the Lump Sum and Death Benefit Allowance (LSDBA) which in the current year is £1,073,100.

Tax relief of 40% or 45% on contributions will usually leave a higher sum for inheritance even after the double deduction of IHT and income tax on benefits, although in some cases the beneficiary may have to pay a higher rate of income tax than the tax relief that was received on the contributions. However the drawdown facility available on many pension schemes should enable the beneficiary to manage the level of income received to help mitigate the potential tax liability.

The negative effects are likely to hit higher earners rather than lower rate earners but the scenarios are complicated and vary significantly depending on individual circumstances. IHT on pensions could create a greater liability than expected, but this in itself should not be seen as a barrier against saving into a pension, as pensions still remain the most tax efficient long-term savings vehicle for most people. For more information or to discuss your own circumstances please get in touch with your usual JJFS contact or email us at justask@jjfsltd.com.

Gifts out of surplus income: 15 points to consider

Inheritance tax receipts continue to rise year on year and reached £8.2bn for the year to March 2025. This figure will increase significantly from 2027 when pensions are included in the taxable estate, and this is naturally driving increased interest in ways to mitigate the impact on pension savings earmarked for wealth transfer. Gifts out of surplus income is one option to consider.

Gifts out of surplus income refers to regular transfers of money or assets made from an individual’s income (not capital) that do not reduce their standard of living and which meet the following criteria:

- Gifts must form part of normal expenditure

- Gifts must be made from income

- Gifts must leave the donor with sufficient income to maintain their usual standard of living

However, the above can be open to interpretation and we have set out some key aspects to consider.

1) When is a gift regarded as ‘normal’ expenditure?

Gifts will usually be made in cash and must form part of a regular and demonstrable pattern of gifting. HMRC will usually consider 3 or 4 years to determine a regular pattern.

2) Do gifts have to be made to the same person?

Gifts do not have to be to the same recipient every year but should be paid to the same class of beneficiary, for example children or grandchildren.

3) Do gifts have to be for the same amounts?

The amount of the gifts will generally be of a comparable size for example the same value or the same percentage of surplus income, but in the case of gifting for a specific purpose, eg school fees, then the actual amount may vary accordingly.

4) Do gifts have to be made at the same intervals?

There are no set intervals and gifts could be monthly, quarterly, 6 monthly or annual. In fact the pattern of gifting could start off on a monthly basis and later change to say annually as long as the annual amounts remain proportionate and are made to the same group of beneficiaries.

5) What is included as income?

Gifts must normally be made from net income received in a tax year, for example, from employment or pension income or income arising from investment such as interest, dividends and rental income.

Click here to download and read the full article which is available as a factsheet on our website.

Could you be liable for tax penalties?

There have been a couple of changes to the law regarding who needs to file a self-assessment return and a recent court case involving HMRC highlights the importance of understanding your compliance obligations as a tax payer and keeping abreast of changes in the law.

For tax year 2023/24, the self-assessment threshold for individuals taxed through PAYE only, changed from £100,000 to £150,000 and from the tax year 2024/25, the threshold is being abolished altogether for employees, regardless of their level of earnings. The Government has also announced plans to remove more taxpayers from the self-assessment filing system in the future. All of this could lead a taxpayer to believe, potentially wrongly, that they are not required to complete a tax return leading to potential fines and tax demands.

In reality, taxpayers are responsible for identifying whether or not a tax return is required and when tax is due. In fact every person has a statutory obligation to notify HMRC if they have a liability to pay tax in a tax year. You should therefore check the requirements to file a tax return annually.

Those who may need to complete a tax return for the 2024/25 tax year and pay tax owed include individuals who:

- are newly self-employed with a total income over £1,000

- are self-employed and earn below £1,000 but wish to pay Class 2 National Insurance contributions (NICs) voluntarily

- have received any untaxed income over £2,500

- are renting out one or more properties

- claim Child Benefit and they or their partner have an income above £60,000

- are a partner in a business partnership

- have taxable income earned from savings and investments more than the £1,000 allowance

- have dividend income of more than £500;

- have capital gains tax to pay on assets that were sold for a profit above the capital gains threshold.

A full list of who needs to complete a tax return is available on the GOV.UK website.

Pensioners are required to pay income tax on any taxable income, including their pension income, above their personal allowance threshold.

Alternatively, if a pensioner does not already pay tax via self-assessment or PAYE, HMRC will send a Simple Assessment summary telling them how much income tax they need to pay and the deadline – usually by 31 January following the end of the tax year. HMRC produces the Simple Assessment from the information it holds along with information it receives from third parties such as bank and building societies. People do not need to do anything – there is no form to complete. More information about Simple Assessment is available on the GOV.UK website.

Abrdn MyFolio Funds Update

Those of you with investments in the Abrdn Myfolio market funds may receive communications regarding a name change/fund merger.

The market and index funds have run alongside each other for several years providing very similar portfolios. Abrdn have now taken the decision to mirror the holdings and have merged them all into index funds.

You do not need to do anything as any changes will take place automatically for you. We remain comfortable that these are still excellent choices for those of you using them and the ongoing costs will be slightly lower than before.

Over the past 6 years Abrdn have successfully grown the MyFolio range to £3.8bn and this year the MyFolio Index won the Best Risk Targeted Range of Funds category at the Professional Adviser Awards 2025.

If you have any questions please get in touch with your usual JJFS contact.

Sign up for our

newsletter

Stay up to date with important issues that affect your finances

5 Tips to Reduce your IHT Burden

download

Some example scenarios that could help reduce the IHT burden on your estate

Auto Enrolment for

employers

What is auto enrolment and what are employers required to do?