Our ...

Auto Enrolment - FAQsThese FAQs are examples of real questions that we’ve been asked whilst assisting employers through the Auto Enrolment process.

Can I offer my employees a pay rise instead of auto enrolling them?

No, you must set up your scheme in time for your staging date and enrol all eligible employees. You mustn’t suggest that they could have a pay increase instead of being automatically enrolled as this is deemed an ‘inducement’ which is prohibited by the Pensions Regulator.

I don’t believe any of my employees will want to join – therefore can’t I just ask them in advance and save all the hassle?

No, all eligible employees must be enrolled, they don’t have a choice prior to enrolment but may choose to opt out after they have been enrolled (and if the first contribution has already been deducted from their salary this will be refunded to them).

We already have a pension scheme, can we just use that?

Possibly, but it needs to be verified as a ‘qualifying workplace pension scheme’. We can guide you with this, including whether or not your current contributions meet the minimum requirements.

We have been notified that our staging date is next month, can you help us arrange a pension scheme?

Probably not, most pension scheme providers require at least 3 months’ notice. Do contact us though and we may be able to guide you further.

We have both weekly paid and monthly salaried staff – how will auto enrolment work for these 2 groups?

Where you have multiple PAYE references, if they are under the same employer the earliest staging date would apply to all employees across the various PAYE References, therefore it is vital to be fully prepared in advance of the earliest staging date.

Where you have both weekly and monthly paid employees an assessment of the workforce will need to be completed every PAYE Reference period therefore you will need to be doing this every week and every month.

Our staff earn a lot of overtime but it varies each month – how do we decide what earnings to base our contributions on?

Where earnings vary each month, if contributions are based on Qualifying Band Earnings or total pay, the amount will vary too. If you prefer a consistent contribution basing contributions on basic salary may be more appropriate. We can help you to calculate the costs of basing contributions on the different earnings definitions.

Are part-time workers included, if they don’t earn the minimum qualifying earnings?

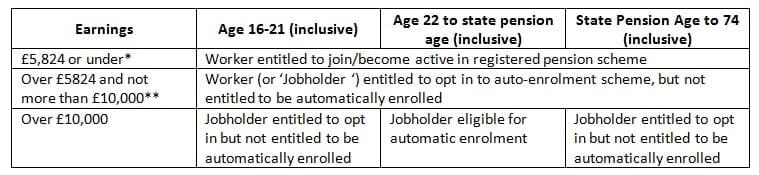

Under the new legislation, those who work under, or have entered into, a contract to do work personally for the employer are defined as ‘workers’ (regardless of whether the contract is express or implied). Therefore part-time staff are included in the new requirements and the table below illustrates the different categories of worker and the main employer duties applicable to them.

* Although these workers are entitled to be enrolled into a registered scheme you are not obliged to pay employer contributions on their behalf.

** You must inform these employees of their entitlement to join a qualifying scheme if they have qualifying earnings and if they choose to do so, you’ll be required to pay contributions for them at the minimum level.

Are temporary employees included?

Yes, providing they are eligible employees. If they are a non-eligible jobholder or entitled worker they can still ask to join.

For additional FAQs, please click to read our Pensions Reform Q&A for Employers.

For more information or to discuss any queries or concerns regarding Auto Enrolment, please email us at justask@jjfsltd.com or call us on 01789 263257.

Sign up for our

newsletter

Stay up to date with important issues that affect your finances

5 Tips to Reduce your IHT Burden

download

Some example scenarios that could help reduce the IHT burden on your estate

Auto Enrolment for

employers

What is auto enrolment and what are employers required to do?