Our ...

December 2014 Newsletter It is already 2½ months since we moved into our new offices which are a great improvement with all the extra space and the ability to facilitate more client meetings on site. We have two meeting rooms on the ground floor with our main offices located upstairs and we’re proud to call Stratford our new ‘home’.

It is already 2½ months since we moved into our new offices which are a great improvement with all the extra space and the ability to facilitate more client meetings on site. We have two meeting rooms on the ground floor with our main offices located upstairs and we’re proud to call Stratford our new ‘home’.

This is our last newsletter of 2014 and we have focused on the 3 main changes arising from the Autumn Statement. We have also included an update on the new intestacy rules which will be sobering reading for those who don’t yet have a Will in place and lastly, we say a fond farewell to one of our office stalwarts.

In this issue:

• Big Changes for Pensions and Death Benefits

• Stamp Duty Reforms – a gift for home buyers

• If you don’t have a Will, who will receive your estate?

Big Changes for Pensions and Death Benefits

As widely predicted, the Chancellor confirmed in the Autumn Statement his plan to scrap the so called 55% death tax on pension death benefits. From April next year, If you die before age 75 all of your personal pension fund can be paid to your spouse or nominated beneficiary as a lump sum, completely tax free. If you die after age 75 your beneficiary can access the pension funds as they wish, either as a flexible drawdown arrangement taxed at their marginal rate, or they can choose to receive a lump sum taxed at 45%. It’s the Chancellor’s intention to reduce this even further to the marginal rate of tax in 2016.

This forms part of the overall pension freedom measures being introduced by the Government and from April 2015 there will also be significant changes to the way you can access your pension. If you are aged 55 or over, you will be able to draw as much of your personal pension as you like without having to purchase an annuity. The first 25% will still be tax free and by taking the rest of your benefits gradually over a number of years, taking into account your personal allowance and any other earnings you may receive, you can significantly reduce the overall amount of tax you pay on your pension benefits.

You can still purchase an annuity if you are looking for a guaranteed level of income for life but the new flexibility to access your benefits coupled with the ability to pass them on tax free to your spouse or beneficiaries, are likely to make them a much less attractive option.

If you are approaching retirement and would like more information on how the new changes will affect you, please get in touch with your usual JJFS contact or email us at justask@jjfsltd.com

New Rules for ISAs

There was more good news from the Chancellor, this time relating to ISAs. In addition to the increased annual contribution limit of £15,240 from April 2015, the value of an ISA can now be transferred on death, free of tax to the surviving spouse or partner. However, rather than transferring the actual ISA funds themselves, the transfer will be achieved by way of an increased ISA allowance for the surviving spouse.

How this will work

Effective 3rd December the surviving spouse or civil partner will be allowed to invest an amount equivalent to the deceased’s ISA into their own ISA via a one off allowance in addition to their normal annual ISA limit for the tax year. This does not have to be the actual assets held within the deceased’s ISA – the surviving spouse can make contributions up to their new allowance from any assets.

Estate planning implications

By separating the transfer of the benefit from the transfer of the actual assets, there is greater flexibility and no adverse impact on existing estate planning arrangements. For example, where the spouse is not intended as the beneficiary of the ISA, or where assets would have been held in trust for the spouse, the ISA holder would need to amend their Will.

Under these arrangements, the spouse will benefit by paying their own assets into their ISA and claiming the higher allowance, whilst the deceased’s assets can still be distributed in accordance with their wishes, as set out in their Will.

Tax implications

The surviving spouse will continue to benefit from the tax free status of the ISA so long as it is kept within the ISA wrapper. The new rules do not provide any additional inheritance tax benefits and the actual ISA assets will be distributed in line with the terms of the Will (or the intestacy rules) and remain within the estate for IHT.

Stamp Duty Reforms – a gift for home buyers

The mortgage side of our business was extremely busy throughout 2014 despite the stricter rules on affordability which came into force earlier this year. Mat Clamp, our Mortgage Principal, arranges both residential and buy to let mortgages and in October alone, the total value of the applications he dealt with was over £6 million. House prices remain strong so the Chancellor’s overhaul of Stamp Duty will bring a welcome saving for homebuyers, particularly for those purchasing property at or just above the £250,000 level. First time buyers and buy-to-let investors will probably benefit most from the stamp duty changes as they are more likely to be purchasing properties around the £250,000 mark. In fact the number of BTL mortgages taken out in the UK has doubled over the past 4 years and currently stands at around 9,000 a month, UK wide.

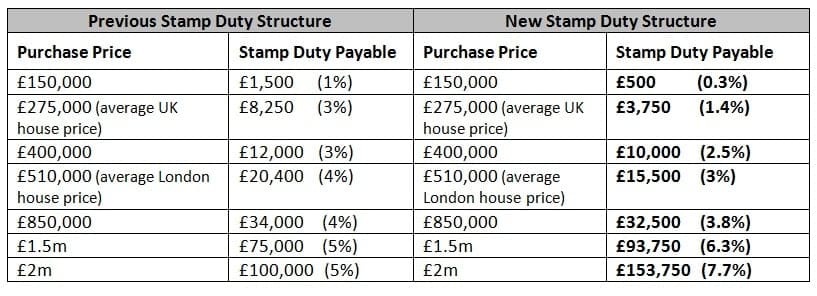

Under the new progressive banding structure no stamp duty is payable on the first £125,000 of the property value, but 2% is payable on the value from £125,001 to £250,000, 5% on the value from £250,001 to £925,000, 10% from £925,001 to £1.5m and 12% over £1.5m.

The table below illustrates the difference in stamp duty payable under the old system versus the new:

The new system came into effect on 4th December so if you completed your sale either on or before the 4th, you will be subject to the old rules. If you exchanged contracts before the 4th but completed after the 4th, you can choose which rules you wish to apply.

If you don’t have a Will, who will receive your estate?

As at 1st October, the intestacy rules were radically overhauled for all estates over £250,000, in order to better reflect our modern society and living circumstances. However there are both winners and losers as a result of these new rules and one group in particular are still being penalised – cohabiting couples.

If you die without a Will, the intestacy rules determine how your estate is distributed. For instance, if you are married without children, the whole of your estate will now go to your spouse, whereas before, your estate was divided between your spouse and your blood relatives. Under the new arrangements any blood relatives, even parents, will not see a penny.

If you are married with children, your spouse will now receive the first £250,000 of your estate as well as half of any remaining assets, with the remaining half going to the children (and held in trust if they are under 18). This simplifies the old arrangements whereby your spouse would have received a life interest in half of the children’s settlement.

As for unmarried couples, with or without children, there is no change whatsoever. The surviving partner will receive nothing and the entire estate will be distributed amongst the surviving blood relatives of the deceased. There is no protection for common law partners regardless of how long the couple have lived together which could result in a distant blood relative inheriting your estate instead of your long term common-law partner.

The only way to ensure that your loved ones are taken care of after your death is to have a valid Will in place.

Farewell to Geraldine

Sadly we will be losing Geraldine Austin, our Group Risk Specialist who will be retiring on 18th December. Geraldine began working with Simon Jackson almost 20 years ago and followed him to JJFS when he and Helen Jeffrey started the business in 2009.

Sadly we will be losing Geraldine Austin, our Group Risk Specialist who will be retiring on 18th December. Geraldine began working with Simon Jackson almost 20 years ago and followed him to JJFS when he and Helen Jeffrey started the business in 2009.

She has always been very popular with colleagues and clients alike and we will all miss her cheery manner and sharp wit. We would like to publicly acknowledge the significant contribution she has made as an integral part of the JJFS team and we wish her well in her retirement. She will be a hard act to follow.

Sign up for our

newsletter

Stay up to date with important issues that affect your finances

5 Tips to Reduce your IHT Burden

download

Some example scenarios that could help reduce the IHT burden on your estate

Auto Enrolment for

employers

What is auto enrolment and what are employers required to do?