Our ...

March 2022 NewsletterWe hope you have had a good start to 2022 and like us, welcome the signs of warmer weather ahead as the colours of Spring begin to emerge. However, we are deeply shocked at events unfolding in the Ukraine and cannot begin to imagine the horrors the Ukrainian people are having to endure. We add our voice and support to the international outcry against the Russian invasion and we hope and pray for a speedy resolution.

Our articles in this issue include a reminder regarding year-end tax planning ahead of 5 April, a somewhat sobering look at the average lifetime tax bill and a potentially alarming analysis of what it really costs to retire.

We hope you find the articles useful.

In this issue:-

- Are You Ready for 5 April?

- National Insurance Rises

- Putting a Cost on Retirement

- Lifetime Tax Bill Hits £1.1M Per Household

- News from JJFS

Are You Ready for 5 April?

The end of the tax year is fast approaching and in some ways tax planning for the 2021/22 year end matters more than in previous years because in 2022/23:

- The personal allowance and income tax bands (other than in Scotland) will be frozen, despite inflation expected by the Bank of England to be running at 6% by April 2022.

- The increases to National Insurance contributions (NICs) and dividend tax announced last September take effect.

The impact of these two is significant. For example, to maintain their buying power, someone in England with a salary of £50,000 a year in April 2021 will need a pay increase of 9.5% in April 2022 to counter the double hit from 6% inflation and higher NICs.

The ‘To-Review’ List

Tax year end checklists change subtly each year, as tax rules change. For this tax year the main items are:

Pensions

5 April 2022 is the final date for taking advantage of any unused pension annual allowance (up to £40,000) from 2018/19. The calculations involved can be complex, so it important to start this element of planning as soon as possible.

Normally any pension contribution up to your available annual allowance will reduce your income tax bill, but the more value you already have in your pension, the more you need to check before adding to it. The same freeze until April 2026 that applies to the income tax personal allowance also fixes the standard lifetime allowance for the next four years. HMRC statistics show that the number of people exceeding their allowance and paying a tax penalty of up to 55% doubled between 2015/16 and 2019/20 (the latest stats available). A headroom check is therefore a wise precaution.

ISAs

With widespread income tax freezes and an increase of 1.25 percentage points in the tax rates on dividends, the value of the tax shelter provided by ISAs has grown. That probably explains why the Chancellor left the maximum contribution for 2022/23 at £20,000, the same level that has applied since 2017/18.

All types of ISA offer four valuable tax benefits:

- Interest earned on cash or fixed interest securities is free of UK income tax.

- Dividends are also free of UK income tax.

- Capital gains are free of UK capital gains tax (CGT).

- ISA income and gains do not have to be reported on your tax return.

For most basic rate taxpayers, the combination of the personal savings allowance, dividend allowance and CGT annual exemption means ISA tax benefits are largely academic. However, it is a different story if you pay income tax at more than basic rate or have exhausted any of your allowances.

As well as considering fresh ISA investment, you could review your existing ISAs, as old cash ISAs offering good rates initially may now be offering negligible returns. For example, despite a recent rate rise, the National Savings & Investments Direct ISA pays just 0.35%. (Even so, that is 35 times more than Halifax is paying on its instant access ISA accounts.)

CGT

Towards the end of last year, a large question mark hanging over of the future of CGT was removed when the Chancellor announced that he would not be implementing most of the reform proposals made in his CGT review in 2020. The year-end CGT exercise is the normal one of considering whether and how to use any remaining CGT annual exemption (£12,300, again frozen to 5 April 2026).

2021 was a good year for most world stock markets – even the FTSE 100 was up 14.3% – so you may well (still, despite recent falls!) have gains that can be set against the exemption. In many instances, it will make sense to take maximum advantage of the exemption as it cannot be carried forward to next tax year; use it or lose it.

Unfortunately, you cannot sell holdings one day and buy them back the next to crystallise capital gains, but there are other ways to achieve much the same result, such as using an ISA or a pension as the reinvestment route.

Inheritance tax (IHT)

The uncertainty facing IHT has also been removed save for one administrative change to IHT which eases the paperwork burden for many executors. IHT year end planning is therefore also business as usual, meaning that you should consider using the three main IHT annual exemptions:

1) The Annual Exemption. Each tax year you can give away £3,000 free of IHT. If you did not use all the exemption in 2020/21, you can carry forward the unused element to this year (and no further), but it can only be used after you have used the current tax year’s exemption. For example, if you made no gifts in 2020/21, and you gift £4,000 in 2021/22, you will be treated as having used your full 2021/22 exemption and £1,000 from the previous tax year.

2) The Small Gifts Exemption. You can give up to £250 outright per tax year free of IHT to as many people as you wish, so long as they do not receive any part of the £3,000 exemption.

3) The Normal Expenditure Exemption. The normal expenditure exemption is potentially the most valuable of the yearly IHT exemptions and one which the OTS wanted to replace. Under the exemption, any gift – regardless of size – escapes IHT provided that:

- you make it regularly;

- it is made from your income (including ISA income, but excluding investment bond and other capital withdrawals); and

- the sum gifted does not reduce your standard of living.

As always, please contact your usual JJFS contact for further information or help.

National Insurance Rises

You may already be aware that National insurance will rise by 1.25 percentage points from April 2022 for a year, to pay for the NHS and social care.

Boris Johnson and chancellor Rishi Sunak said that the rise “must go ahead”, insisting it is the “right plan”, despite calls for it to be delayed or even scrapped as households face increased food and energy bills. Business leaders have warned that firms could offset the rise by hiking up prices.

In an article in the Sunday Times, they said the increase would help clear the NHS backlog. But what does this mean in practice?

An employee earning £20,000 a year will pay an extra £89 and someone on £50,000 will pay an additional £464.

From April those earning under £9,880 a year will not have to pay NICs and will not have to pay the new levy.

Putting A Cost On Retirement

£185.15 a week. That is what the new state pension will be after the increase due in April 2022. By then, the uplift of 3.1% could be around half the going rate of inflation. Had the pension benefited from the temporarily abandoned Triple Lock, it would rise by 8.3%. Even with that increase the state pension would still not reach £200 a week, yet alone be enough to cover the frozen income tax personal allowance, equivalent to about £242 a week.

So, how much retirement income do you need?

The calculation of required retirement income has traditionally taken two forms:

- Proportion of final earnings This approach is the foundation on which final salary pension schemes were built. It assumes that your pension income before tax should be a fixed proportion of your earnings in the final year(s) of employment, The target fraction adopted by many pension schemes, both in the public and private sector, was two thirds.

- Target living standard The final salary calculation is arbitrary: it assumes that both the chief executive and the lowest paid employee both need the same proportion of gross pay. In practice, for the chief executive, the formula may produce an excessive figure, particularly once tax is allowed for, whereas, at the opposite end of the scale, two thirds of not-very-much can be far-too-little. To counter this potential distortion, some retirement experts ignore pre-retirement income and consider a post-retirement question: how much net income is needed to meet a given standard of living?

Neither method is designed to give as good an answer as an individual assessment based on personal expenditure. However, they provide a helpful starting point for generalised calculations.

The Pensions and Lifetime Savings Association (PLSA) basis

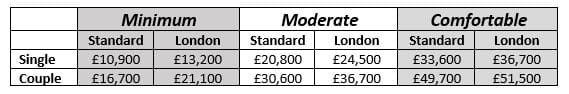

In 2019, the PLSA joined with Loughborough University to develop a table of target retirement incomes based on three different living standards:

- Minimum, a level of income which covered all needs, with ‘some left over for fun’;

- Moderate, a higher level of income, providing more financial security and flexibility; and

- Comfortable, the top level of income, giving more financial freedom and ‘some luxuries’.

The PLSA considers six categories under each standard. For example, under the Transport category, the minimum standard makes no provision for a car, while the comfortable standard envisages a couple having two cars, each replaced every five years.

The latest results

Towards the end of 2021, the PSLA updated its tables, taking account of how prices and spending habits had changed since 2019. For example, a Netflix subscription was added to the minimum and moderate standards while the comfortable standard saw the inclusion of annual maintenance and servicing of a burglar alarm. The net annual income numbers are shown below:

Unless you aspire only to the minimum standard of living, the state pension will leave you with a significant shortfall. At the comfortable end of the retirement spectrum, tax can push up gross income requirements to high levels. If a couple living outside London are relying upon the income of only one spouse or civil partner, then he or she will need gross income of nearly £62,000 to reach the net income goal of £49,700.

If you have any queries or would like assistance with your own retirement planning, please get in touch with your usual JJFS contact or email us on justask@jjfsltd.com.

Lifetime Tax Bill Hits £1.1M Per Household

As Benjamin Franklin famously said, “in this world, nothing is certain except death and taxes” and a report published by the TaxPayers’ Alliance has put a figure on the average lifetime tax bill.

According to their report, the average household will pay over £1.1m in tax in their lifetime, meaning they would have to work for 18 years just to pay off their tax bills.

The main findings of the report, entitled Lifetime Tax, include:

- Over a lifetime, 40 years working and 15 years retired, an average household will pay £1,101,255 (in 2019/20 prices) in direct and indirect taxes. While household incomes have increased, the lifetime tax has almost doubled in real terms from the amount of tax the average household paid in 1977.

- In 2019/20, an average household received income of £60,194. With this level of income it would take more than 18 years just to pay their lifetime tax bill.

- Households in the bottom 20% by income will pay £449,860 in direct and indirect taxes over a lifetime.

- Households in the bottom 20% received income of £19,171 in 2019/20. This means it would take them almost 24 years just to pay their lifetime tax bill.

- Over a lifetime, households in the top 20% by income will pay £2,573,815 in direct and indirect taxes.

- The top 20% of households received income of £137,669 in 2019/20. It would take them almost 19 years to pay their lifetime tax bill alone.

- The total lifetime tax has fallen on only four occasions from the previous year since 1977. These were: 2002/03; 2008/09; 2012/13; and 2015/16.

- Over a lifetime, an average household will pay £479,430 of income tax; £187,570 of VAT; £140,745 of employee’s national insurance contributions; £79,415 of council tax; and £37,435 of employers’ national insurance contributions.

- It would take more than 33,500 average households’ total lifetime taxes to pay for the £37 billion cost of test and trace and almost 4,100 to cover the costs of benefit overpayments in 2019/20 alone.

The figures show that the lifetime tax bill has almost doubled since 1977, only falling on four occasions during that time.

The Taxpayers’ Alliance has launched a new online calculator, enabling users to calculate their own lifetime tax bill.

All of this highlights the importance of considering tax planning for the current tax year and putting in place strategies to minimise tax throughout the next tax year. The majority of planning strategies have greatest effect if implemented before a tax year begins.

For further help and information please get in touch with your usual JJFS contact or email us at justask@jjfsltd.com

News from JJFS

It’s hard to believe that we are almost 2 years on since the first lock down but as restrictions have eased over the past few weeks, we are now fully back to working in the office and enjoying the camaraderie of working together again in person. That said, we will continue to conduct client meetings via Teams where possible in an effort to minimise any potential risk. This also enables greater flexibility in the timing and availability of meetings.

Simon has burst out of winter hibernation and is training hard for a duathlon in the Mumbles on 26th March. We will of course bring you photographic evidence of his efforts in due course.

Our next update will be the new tax tables following the Chancellor’s Spring Statement on 23rd March.

PLEASE NOTE:

These articles do not constitute any form of personal advice or recommendation and are not intended to be relied upon in making (or refraining from making) any investment or financial planning decisions.

Sign up for our

newsletter

Stay up to date with important issues that affect your finances

5 Tips to Reduce your IHT Burden

download

Some example scenarios that could help reduce the IHT burden on your estate

Auto Enrolment for

employers

What is auto enrolment and what are employers required to do?