Our ...

October 2021 NewsletterWe hope life has begun to return to some semblance of normal for you, indeed at JJFS we have taken a step closer towards ‘normality’ as all JJFS staff are now based in the office again albeit with some social distancing measures in place. More JJFS news in our article below.

Another budget is almost upon us and we will issue the usual updated tax tables along with a summary of the main announcements.

In the meantime, our articles in this issue focus on retirement with a mix of articles that should be of interest to all, not just those of you at or in retirement. We hope you find them useful.

In this issue:-

- The Implications of the Minimum Pension Age Increase

- What Has Netflix got to do with your retirement living standard?

- Confusion over the State Pension

- Lost Pensions and Small Pots – the case for Consolidation

- The Changing Relationship between Interest and Inflation

- News from JJFS

The Implications of the Minimum Pension Age Increase

On 6th April 2028 the minimum pension age will increase from 55 to 57 and will affect all those born 6th April 1971 onwards.

If you were born after 5th April 1973 you will have to wait an extra two years to access your pension benefits but there is a window of opportunity for those born during the two years from 5th April 1971 to 5th April 1973 as the rules will enable them to access their pension benefits between their 55th birthday and 6th April 2028.

There are a number of implications arising from this change for pension scheme members although schemes with a stated minimum age of 55 will retain that protection and existing members and any new members who join by 5th April 2023 will be unaffected.

Many schemes, however, apply the ‘normal pension age’ definition and will therefore default to age 57 in April 2028, so members of these schemes will have to wait up to an extra couple of years. But even these members have been given an option as the Government is allowing transfers to age 55-protected schemes so long as the transfer is completed before 5th April 2023. In some cases the funds will be ringfenced though, and it’s possible all new contributions will have to go into a separate arrangement until the member is 57.

As always, there are exceptions, and the rules are complex but we will be in touch with you to discuss your own circumstances at your usual review.

What has Netflix got to do with your retirement living standard?

It’s likely you have a reasonably clear idea of the standard of living you would like to maintain during your retirement but have you compared your thoughts to the definitions set by the Pensions and Lifetime Savings Association (PLSA)?

The PLSA sets three living standards – minimum, moderate and comfortable – and these levels are regularly reviewed and updated to reflect changes in consumer expectations as well as rising costs and price inflation.

Following the pandemic, the PLSA has updated its standards based on consumer expectations shaped by the various lockdowns and has now included a Netflix subscription as well as more money for personal grooming within their latest definitions. They believe the pandemic has emphasised the importance of economic security and the value of activities that we may have had curtailed during the lockdowns.

The minimum level requires an annual retirement income of £10,900 (£16,700 for a couple) which includes one week’s holiday in the UK per year, eating out once a month and some affordable leisure activities twice a week.

The moderate living standard requires an income of at least £20,800 a year (£30,600) which provides more financial security as well as a fortnight’s holiday in Europe and eating out several times a month.

To enjoy a comfortable lifestyle, you will need £33,600 a year (£49,700 per couple) which includes regular beauty treatments, theatre trips and 3 weeks away in Europe each year.

The PLSA work hard to ensure their standards reflect real prices and real expectations and are a useful benchmark when considering the level of income you might need during your own retirement and whether you are saving enough for the retirement lifestyle you would like.

For further help or advice in relation to your own circumstance please get in touch with your usual JJFS contact or email us at justask@jjfsltd.com

Confusion over the State Pension

A recent survey by Opinium revealed a concerning level of confusion regarding the state pension amongst the 2000 people who took part.

The current full state pension is £179.60 a week whereas a quarter of respondents were expecting more, at around £200 a week. A third had no idea how much to expect and a quarter of those in the 45-54 age group were confused as to when their state retirement age was anyway.

Despite the increases in the state pension, research carried out by Hargreaves Lansdown discovered that over 2m pensioners currently receive less than £100 a week.

Young people especially, are confused as to their state pension age and the income they are likely to receive, although that’s not entirely surprising given the distant timeframe involved. They may also be expecting further rises in the state pension age before then.

If you are unsure about your own state pension and what you’re likely to receive, you can apply online for a state pension forecast which will highlight potential gaps in your retirement planning and any adjustments you may need to make.

Click here to begin the process.

Lost Pensions and Small Pots – the case for Consolidation

The introduction of auto enrolment in 2012 has successfully increased the number of people actively saving toward their retirement but has also contributed to a proliferation of very small pension pots as people move from job to job.

More than one in four adults now have at least one pension pot of less than £5,000 and it is estimated that there are around 8 million deferred pension pots (i.e. static and not being used to make contributions or withdrawals) which could rise to as many as 27 million by 2035.

Although many people are unaware that they can consolidate smaller pots into one easily managed pension, a common concern amongst those who are, is not wanting to put all their eggs in one basket. This is not only a misnomer but completely ignores all the benefits of consolidation.

In some cases a larger pot will benefit from lower fund charges and a wider investment choice and it’s much easier to keep track of one pension, simplifying the administration for savers as well as providers.

The Government is currently looking at ways to mitigate the profusion of small pots and is developing proposals for a low-cost auto-consolidation option to facilitate transfers for the auto enrolment mass market.

In the meantime, October 31st sees the launch of the UK’s first National Pension Tracing Day, designed to raise awareness and encourage people to track down their lost pensions and get a clearer picture of their retirement savings. You can go online to the Pension Tracing Service which will help you locate any schemes that you may have forgotten about or lost track of over the years.

For further help and information please get in touch with your usual JJFS contact or email us at justask@jjfsltd.com

The Changing Relationship between Interest and Inflation

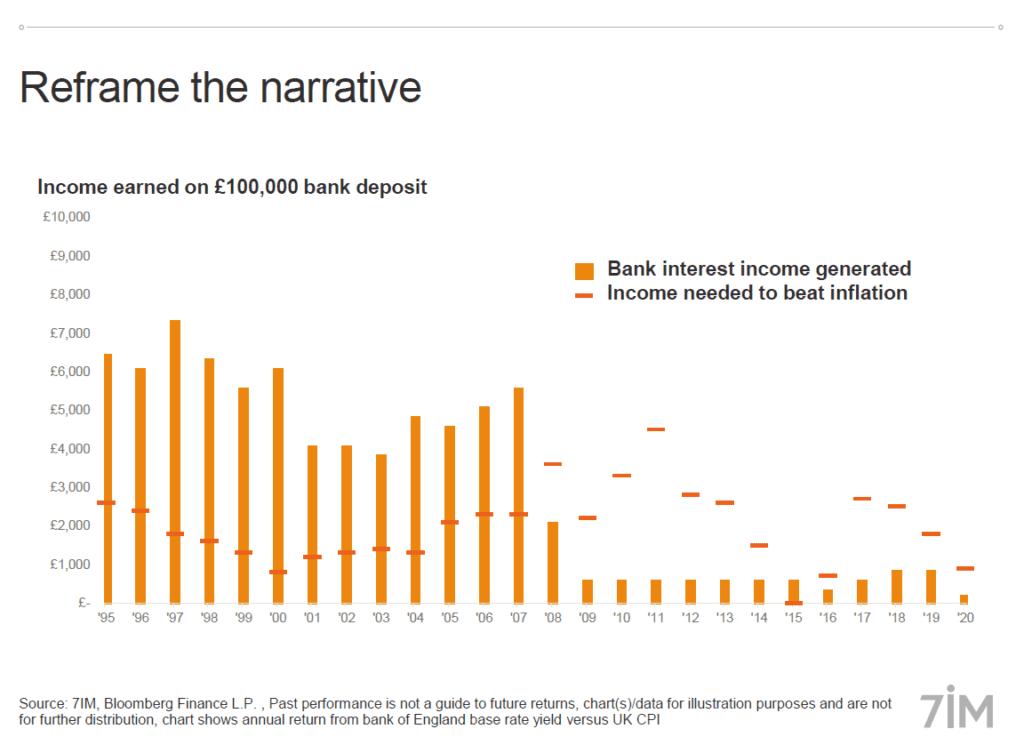

We thought we would share this interesting graphic illustrating the relationship between inflation and bank interest from 1995 to 2020. Borrowers have been the clear winners for well over a decade now although this could be coming to an end given the recent comments from the Bank of England regarding possible rate rises beginning next year.

News from JJFS

Following many months of working from home our team have finally reunited and are all now working from the office. We have slightly reconfigured the layout to allow for social distancing but it is good to be back working together, not least for our usual office camaraderie and morale.

However, we are continuing to hold client meetings and reviews virtually via Microsoft Teams as this has proved so successful in enabling us to offer more flexibility to suit our clients alongside increased efficiency in managing our workload and time, not to mention benefits to the environment by reducing the number of hours we used to spend on the train and in the car.

Outside of the office, Simon has leapt back into sporting endeavours with a vengeance and has progressed from heaving a tractor tyre in a deserted car park (remember that?) to an impressive list of events including three 10k runs and the Myton Hospice 100k charity bike ride, two of which took place on what feels like the only two days of rain we’ve had for months.

Helen, on the other hand, has been just as busy with an arguably more sedate, but potentially more hazardous, hobby – beekeeping. We managed to persuade her to share a photo in full garb and we look forward to the JJFS honey production line next year.

PLEASE NOTE:

These articles do not constitute any form of personal advice or recommendation and are not intended to be relied upon in making (or refraining from making) any investment or financial planning decisions.

Sign up for our

newsletter

Stay up to date with important issues that affect your finances

5 Tips to Reduce your IHT Burden

download

Some example scenarios that could help reduce the IHT burden on your estate

Auto Enrolment for

employers

What is auto enrolment and what are employers required to do?